Unearthing the roots of your money story

Money, it is said, makes the world go around. We use it daily, exchange it for goods and services, save it for the future, worry about it, celebrate it, and yet often, we are reluctant to delve into our personal histories with it. Our earliest memories of money can reveal much about our present-day financial […]

The spectre of financial uncertainty

The spectre of financial uncertainty can have substantial impact on one’s psychological well-being and future planning capabilities. However, it is not a burden that has to be perpetually borne. Transitioning from financial uncertainty to stability is achievable by reducing chaos in your cash flow and introducing a greater degree of predictability into your financial planning. […]

Data to Wisdom for your financial journey

As we journey through life, we often hear phrases like “seeing is believing”. But when it comes to our financial health and well-being, there’s a subtle yet profound difference between merely seeing and truly recognising. It’s akin to looking at a tree and appreciating its beauty, compared to recognising its species, understanding its growth patterns, […]

Unleash the power of articulating your financial plan

In the sphere of financial planning, the way we speak about money and articulate our plans can have a profound impact on our financial well-being. The power of articulating a financial plan lies not only in the creation of a roadmap towards your financial goals, but also in how it helps shape your mindset towards […]

Time to think about money – Part 2

Independent thinking is critical in lifestyle financial planning, and here’s why. Each person has unique financial needs, aspirations, and circumstances. When you think independently, you can assess your personal situation and determine what matters most to you. This helps you set goals that genuinely reflect your values and priorities, making your financial plan more meaningful […]

Decoding the Language of Money

Just like our language influences our perceptions of the world, the language we use around money – especially the complex jargon and market commentary that often surrounds it – can significantly impact our financial behaviours, perspectives, and, ultimately, our financial planning. You’ve likely heard phrases like “money doesn’t grow on trees”, “time is money”, or […]

Mapping out major milestones with your money

We understand the significance of both the major and minor financial decisions in your life. From daily expenses to life-changing events like weddings, welcoming a new child, or buying a home, we are here to guide you. Let’s explore how you can expertly navigate these significant financial moments. Tying the Knot without Knotting Your Finances […]

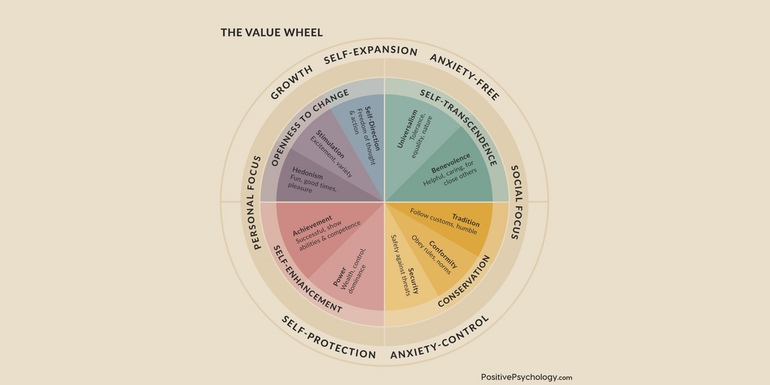

Harnessing Your Core Values: Living Life Intentionally

We all have them�those intangible principles that underpin our behaviours, guide our decisions, and give our life its unique flavour. They’re our core values, the quiet compass steering us through the complex labyrinth of life. This week, we at Victus are putting the spotlight on these powerful drivers and their role in crafting a purposeful, […]

A lifestyle-centric retirement approach

Imagine your perfect retirement. Are you relaxing at your local coffee shop at 10am on a Tuesday? Maybe you’re tending to your dream garden, or perhaps you’re finally turning that passion project into a full-time venture. Maybe you�re spending three months of the year with your kids and grandchildren. No matter your vision, at Victus, […]

The healthy balance between financial health and personal happiness

Financial health and personal happiness�two elements that make up the core of a fulfilling life. At Victus, we believe these aren’t mutually exclusive; they blend seamlessly to shape your unique lifestyle. A lifestyle that isn’t defined by compromises but by the perfect harmony of financial well-being and personal satisfaction. We believe you don’t have to […]